Stillman School of Business

In the Master of Business Administration (M.B.A.) in Finance program, you'll build the theoretical foundations and gain the hands-on experience you need to excel in the financial services industry. Many of our MBA finance graduate students go on to pass all three CFA-level examinations.

Our M.B.A. program combines a strong core curriculum with electives that let you map your own path, and we keep the program streamlined to just 40 credits. Our finance coursework provides a comprehensive foundation in financial theories, quantitative methods, and investment analysis, aligning closely with the core topics covered in the CFA examinations. The rigorous assignments and case studies often mirror real-world financial scenarios, equipping students with the practical knowledge and analytical skills essential for the CFA's in-depth exams. The structured environment of an M.B.A. program at Seton Hall fosters discipline, time management, and a deep-dive approach, all of which are critical for successfully navigating the three levels of the CFA exams.

We welcome both full and part-time students and our small and flexible classes to accommodate your schedule on our main campus in South Orange, NJ, which is only 14 miles away from New York City.

Accreditation & Awards

"I really want students to appreciate financial knowledge and be able to develop their critical thinking, then apply that knowledge to analyze the real financial world."

Admissions Requirements

Admission into the Stillman School of Business is selective. For consideration, applicants must hold a baccalaureate degree from an accredited college or university. The School welcomes applicants from business and non-business undergraduate majors. Although all requests will be considered based on individual merit and each candidate will be evaluated holistically, an undergraduate overall GPA of 3.0 or higher (on a 4.0 scale) is generally required.

Deadlines

-

Fall Priority

May 31

-

Spring Priority

October 31

-

Summer Priority

March 31

Applications are processed on a rolling basis. To be considered for competitive merit scholarships or Graduate Assistantship positions, applicants are encouraged to apply by the priority deadline for each semester.

Curriculum Overview

With a focus on an ethics-centered education, our M.B.A. starts with a core curriculum that covers accounting, economics, the behavioral and quantitative sciences, and the functional areas of business. The M.B.A. curriculum requires 40 credits of study, which includes core courses (25 credits) and electives (15 credits).

There are many paths to follow. With a finance focus, you can choose from diverse courses, such as:

- Capital and Money Markets

- Corporate Finance

- International Finance

- Portfolio Analysis

- Sports Finance

You'll have the opportunity to consult with an actual client in our M.B.A. consulting course.

Expect small class sizes and dynamic discussions with your peers, industry professionals and professors whose expertise spans organizational behavior, corporate social responsibility, labor relations, international business, entrepreneurship, and more.

-

73

US News Best Part-time M.B.A. Ranking

-

18

NYC Final 4 Wins, CFA Institute Research Challenge

-

20

Hours of Student Volunteer Service

Career Opportunities

Graduating with your M.B.A. from Seton Hall University opens a wide array of opportunities both locally and abroad. With an M.B.A. in Finance, you'll be prepared to take on exciting, well-paid positions across growing industries.

Finance graduate students are prepared to delve deep into the intricacies of financial management, investment strategies, and market analysis. Graduates can navigate the complex world of banking, taking on roles such as Investment Banker, Portfolio Manager, Budget Analyst, or Financial Analyst/Examiners. They might also explore opportunities in corporate finance as CFOs or Financial Managers, steering the financial direction of established companies or emerging startups. Asset management is another opportunity, allowing graduates to become Fund Managers or Financial Advisors, guiding investments and retirement portfolios. Beyond traditional finance roles, they can leverage their expertise in consulting, and advising firms on mergers, acquisitions, or capital market strategies.

91%

Corporate Recruiters Surveyed Who Plan to Hire MBA Graduates.

$125k

Estimated Median Starting Salary for MBA Earners in the U.S. (2023)

1:1

Academic & Career Advising

Our alumni work at the best businesses around the world.

Our Faculty and Students

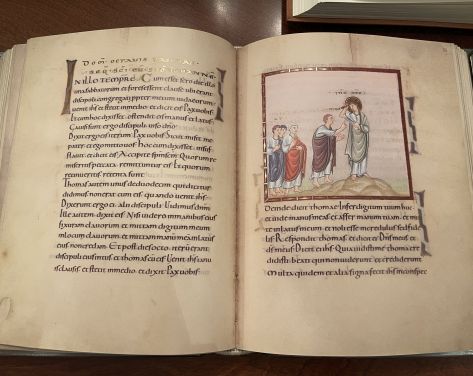

Seton Hall Team Wins NY Area CFA Institute Research Challenge

MBA Business Consulting Class to Advise World’s Oldest Library in Verona, Italy

Scholarships & Financial Aid

Seton Hall University is committed to providing students with the most current information on how to finance your graduate degree. A graduate degree is within your reach – a variety of options can help you finance your degree including scholarships, federal aid, graduate assistantships, and more.

-

50%

Amount Scholarships Can Reduce Cost of Degree

Frequently Asked Questions

What are the pre-qualification course requirements?

To help students update and refresh their basic business skills, students without a business background will be required to complete a sequence of self-paced, prequalification courses that do not bear credit and can be completed quickly online. All pre-qualification courses are offered year round during every semester.

What is the time and frequency of on-campus classes?

Classes are usually offered in the evenings with 6:30 p.m. start times and typically meet once or twice a week for 2.5–3.5 hours.

See all Graduate Admissions FAQs

View a complete list of Stillman School of Business graduate admissions frequently asked questions.

Additional Resources

Joint Degrees

Graduate Certificates

Learning Outcomes and Assessment

Request More Information

Loading M.B.A. in Finance ...

About Seton Hall

One of the country's leading Catholic Universities, Seton Hall University has been developing students in mind, heart and spirit since 1856.

Home to over 10,000 undergraduate and graduate students and offering more than 90 undergraduate programs and over 130 graduate programs, Seton Hall's academic excellence has been singled out for distinction by The Princeton Review, U.S. News & World Report and Bloomberg Businessweek.

Seton Hall's 58-acre campus in the quaint town of South Orange, New Jersey, is only 14 miles from New York City — offering students a wealth of employment, internship, cultural and entertainment opportunities. The University’s nationally recognized School of Law is located in nearby Newark, New Jersey. The Interprofessional Health Sciences (IHS) campus in the owns of Clifton and Nutley, New Jersey, houses the University’s College of Nursing and School of Health and Medical Sciences.

-

1856

Founded by James Roosevelt Bayley

-

14

Miles from New York City

-

90+

Career-Building Graduate Programs